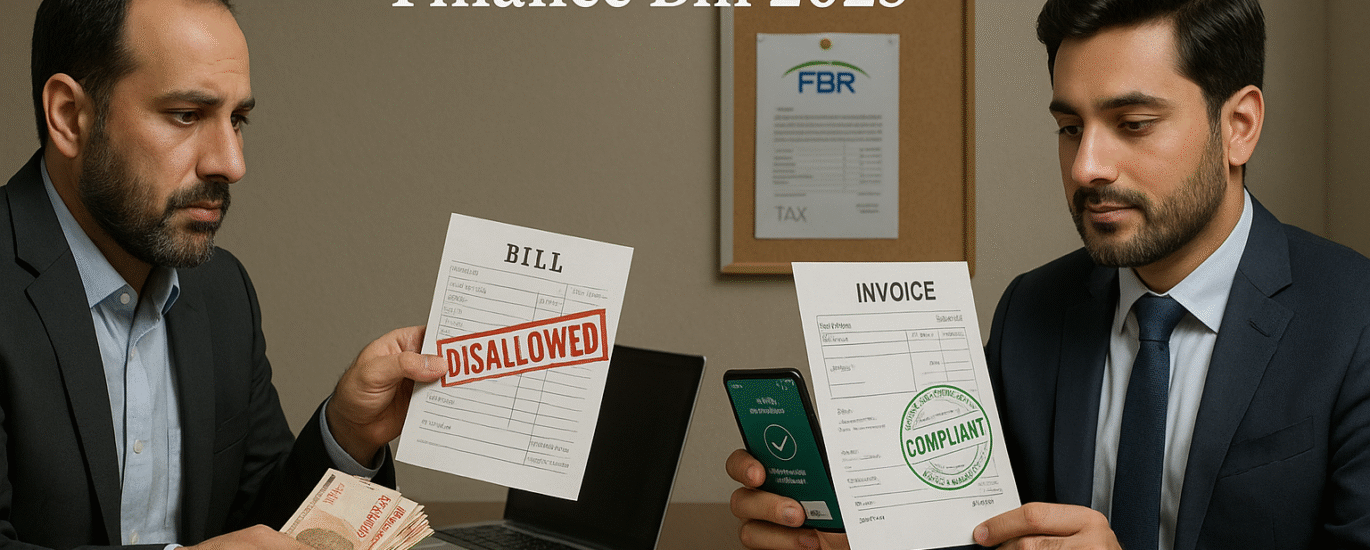

The Finance Bill 2025 introduces significant changes to Section 21 of the Income Tax Ordinance, 2001, aiming to discourage undocumented transactions and enforce digital/banking payment compliance. These amendments directly impact the allowability of business expenses, targeting two key areas:

Purchases from unregistered persons (non-NTN holders)

Sales made without banking/digital payment methods

This blog breaks down the updated provisions, explains their scope, and provides answers to frequently asked questions.

📜 Summary of Amendments in Section 21

✅ Clause (q): Disallowance on Purchases from Non-NTN Holders

New Provision:

“Ten percent of the claimed expenditure made attributable to purchases made from persons who are not National Tax Number (NTN) holders shall be disallowed.”

Exceptions:

In case of agricultural produce, the restriction only applies if the purchase is made from a middleman.

FBR may issue exemptions for certain persons or classes through official notification.

Implication:

If a business purchases goods from an unregistered supplier, 10% of that expenditure cannot be claimed as a deduction for tax purposes.

Incentivizes dealing with registered, documented suppliers.

✅ Clause (s): Disallowance for Non-Banking Sales Receipts

New Provision:

“Fifty percent of the expenditure claimed shall be disallowed in respect of sales where the taxpayer received payment exceeding Rs. 200,000 in cash or through non-digital means against a single invoice involving one or more transactions.”

Key Conditions:

Applies to sales or provision of services.

Triggered where payment exceeds PKR 200,000 and is not made through banking or digital channels.

Implication:

If a business receives cash payments exceeding Rs. 200,000 per invoice, half of the related expenses become non-deductible.

Strongly pushes businesses toward formal payment channels.

💼 Practical Scenarios

| Scenario | Disallowance Impact |

|---|---|

| Purchase from a roadside vendor without NTN | 10% of purchase cost disallowed |

| Buying wheat from a farmer directly | Allowed (not a middleman) |

| Buying vegetables via a middleman | 10% disallowed |

| Receiving Rs. 300,000 in cash for a single sale | 50% of expense related to that sale disallowed |

| Receiving Rs. 150,000 in cash for sale | No disallowance (below threshold) |

| Payment received via online bank transfer | Fully allowed |

🧾 Policy Objective Behind the Amendments

These changes reflect a compliance-oriented tax policy aimed at:

Curbing cash-based, undocumented transactions

Encouraging use of banking and digital systems

Incentivizing supplier registration (NTNs)

Enhancing FBR’s audit trail and transparency

✅ 20 Frequently Asked Questions (FAQs)

Q1: What is Section 21 of the Income Tax Ordinance, 2001?

A: It outlines expenditures that are not allowable for tax deduction when computing taxable business income.

Q2: What’s new in clause (q)?

A: Now, 10% of purchase expenses from non-NTN holders are disallowed unless the seller is a farmer, not a middleman.

Q3: Who is considered a middleman?

A: An intermediary who buys produce from farmers and resells to businesses, usually without value addition.

Q4: What happens if I buy from a non-NTN holder but it’s a small vendor?

A: Still subject to 10% disallowance, unless the vendor falls under an FBR exemption.

Q5: What is the logic behind the 10% disallowance?

A: To encourage documentation and registration of vendors.

Q6: Are there exemptions to clause (q)?

A: Yes, the FBR may notify exemptions for specific persons or sectors.

Q7: What is clause (s)?

A: It disallows 50% of expenses related to sales where payment exceeds Rs. 200,000 in cash or non-digital form.

Q8: Does this apply to multiple invoices?

A: The restriction applies per invoice, even if it includes multiple items or transactions.

Q9: Are cheques acceptable under clause (s)?

A: If cleared through the banking channel, yes. Otherwise, non-cleared cheques may fall under disallowance.

Q10: What is considered “digital means”?

A: Bank transfers, debit/credit card payments, mobile wallets, Raast payments, etc.

Q11: Can businesses restructure invoices to avoid this?

A: Artificial splitting of invoices may be treated as tax avoidance and challenged during audits.

Q12: What if a customer insists on paying in cash?

A: The law places responsibility on the seller, so disallowance will still apply.

Q13: Does clause (s) apply to service providers too?

A: Yes, it applies to sale of goods and provision of services.

Q14: Will FBR issue further rules?

A: Possibly, through SROs or clarifying circulars post-implementation.

Q15: Are small traders affected?

A: If they are registered and filing returns, yes. But informal/unregistered persons may already be outside the system.

Q16: Will this affect ATL (Active Taxpayer List) status?

A: Not directly, but disallowances could impact tax liability and audit exposure.

Q17: Are bank deposits proof of digital receipt?

A: Only if the deposit is linked to customer-originated payment, not anonymous cash deposits.

Q18: Is there any way to avoid clause (s) disallowance?

A: Ensure all sales over Rs. 200,000 are routed through bank or digital channels.

Q19: How will auditors verify this?

A: Through sales ledgers, payment vouchers, bank statements, and invoice reviews.

Q20: When is this effective?

A: Applies from the tax year 2025, upon enactment of the Finance Act.

The 2025 amendments to Section 21 reflect Pakistan’s strategic push toward a documented, digitized economy. Businesses must adapt by:

Ensuring suppliers have valid NTNs

Processing high-value sales through banking/digital channels

Maintaining transparent audit trails

Non-compliance can result in substantial tax disallowances, affecting profit reporting and increasing the risk of audits. Proactive planning and digital integration are now essential for sustainable tax compliance.