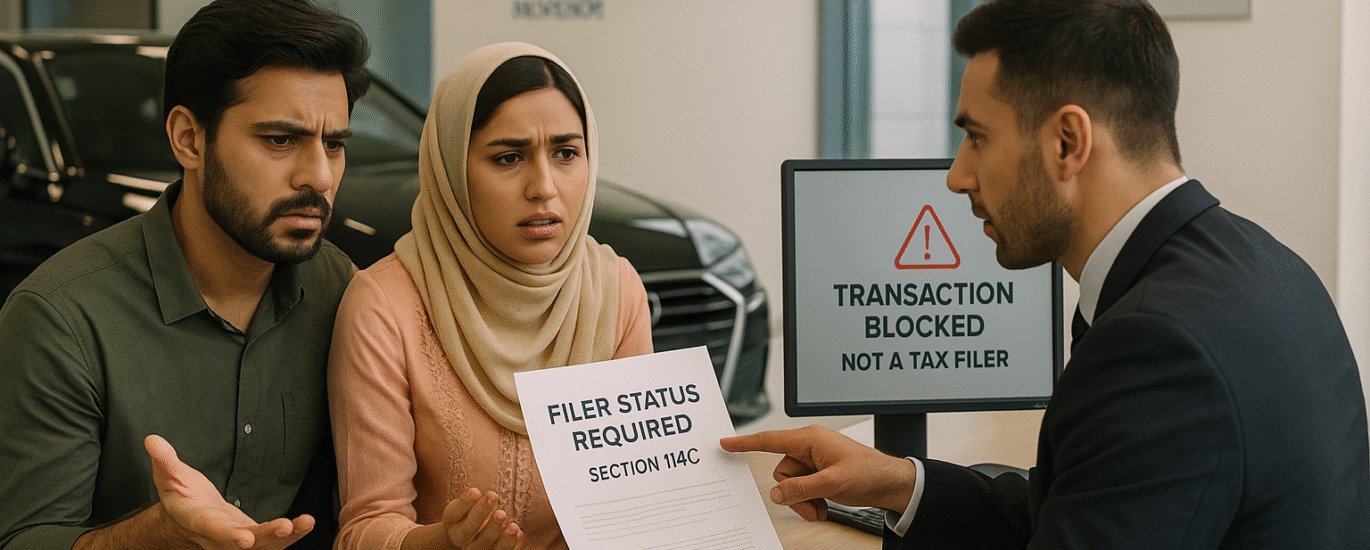

The Finance Bill 2025 introduces a powerful compliance mechanism through Section 114C of the Income Tax Ordinance, 2001. This new provision restricts non-filers and ineligible persons from undertaking major economic transactions in Pakistan.

The goal is to compel individuals and businesses to file income tax returns, disclose assets, and report sufficient resources before making high-value transactions.

⚖️ What Does Section 114C Introduce?

Section 114C places economic restrictions on ineligible persons by prohibiting or limiting their ability to:

Book, purchase, or register motor vehicles exceeding certain value limits.

Buy, transfer, or register immovable property over a prescribed value.

Invest in securities, mutual funds, or similar accounts beyond thresholds.

Withdraw large amounts of cash from bank accounts exceeding specified limits.

These restrictions will be enforced by manufacturers, Excise Departments, banks, and regulatory bodies, based on thresholds defined in the Fifteenth Schedule.

👥 Who Are Eligible vs. Ineligible Persons?

✅ Eligible Person is someone who:

Has filed an income tax return for the immediately preceding tax year, and

Has declared sufficient resources in:

A wealth statement (individuals), or

A financial statement (companies/AOPs), or

Filed a “sources of investment and expenditure” statement for a particular transaction.

Immediate family members of such individuals (parents, spouse, dependent children) are also treated as eligible.

❌ Ineligible Person is:

Anyone not meeting the above criteria — in other words, non-filers or those who haven’t declared resources before engaging in certain transactions.

💼 Transactions Affected by Section 114C

| Type of Transaction | Restriction |

|---|---|

| Purchase/registration of motor vehicles | Not allowed if value exceeds threshold (Fifteenth Schedule) |

| Registration of immovable property | Prohibited for ineligible persons if above threshold |

| Investment in securities/mutual funds | Blocked if investment exceeds allowed limit |

| Cash withdrawals | Capped; no withdrawals exceeding threshold allowed |

⚠️ Note: These restrictions do not apply to non-residents and public companies, except for cash withdrawal limits.

💰 What Are “Sufficient Resources”?

Defined as:

130% of cash and cash-equivalent assets, such as:

Local/foreign currency

Gold

Stocks, receivables, or bonds

Any declared capital asset exchanged for another

Must be declared in:

Wealth Statement (for individuals), or

Financial Statement (for companies/AOPs), or

Sources of Investment and Expenditure Statement (filed online with FBR)

📅 When Will Section 114C Apply?

The restrictions will come into effect on a date notified by the Federal Government in the official Gazette, which may also adjust transaction thresholds.

📜 Legal Safeguards

Filing a sources of investment and expenditure statement does not trigger Section 111 (unexplained income) consequences.

Previously declared capital assets exchanged for property will still be treated as valid sources if documented.

📊 Why It Matters

Section 114C is aimed at:

Documenting the economy

Encouraging return filing

Preventing tax evasion through luxury spending

Bringing high-value transactions under regulatory oversight

🧾 20 Frequently Asked Questions (FAQs)

Q1: What is Section 114C?

A: It restricts high-value economic transactions by non-filers or ineligible persons.

Q2: Who enforces these restrictions?

A: Banks, Excise & Taxation Departments, property registration authorities, and investment platforms.

Q3: What is the threshold limit?

A: As per the Fifteenth Schedule, to be notified by FBR.

Q4: Can a non-filer buy a car or property?

A: No, if the value exceeds the prescribed threshold and they are ineligible.

Q5: Is this applicable to non-residents?

A: No, except for cash withdrawal limits.

Q6: How can I become eligible?

A: File your latest income tax return and declare sufficient resources.

Q7: What are “sufficient resources”?

A: 130% of cash or equivalents declared in wealth or financial statements.

Q8: Are mutual fund investments also restricted?

A: Yes, if the total investment exceeds threshold and you’re ineligible.

Q9: Can my children buy a car if I’m a filer?

A: Yes, if they are dependent family members of an eligible person.

Q10: Can I file a statement instead of a return?

A: Yes, you may file a sources of investment and expenditure statement.

Q11: Will this trigger Section 111?

A: No, these declarations are protected from being treated as unexplained income.

Q12: What if I exchanged a declared plot for a car?

A: The declared asset’s value is accepted as a valid source.

Q13: Can a company be restricted?

A: Public companies are exempt (except for cash withdrawal rules).

Q14: Will banks block my withdrawals?

A: Yes, if your withdrawal exceeds the notified cash limit and you are ineligible.

Q15: Is this different from Active Taxpayers List (ATL)?

A: It’s related — you must file returns and declare assets to become eligible.

Q16: Can I be penalized under this section?

A: No explicit penalty, but you’ll be barred from certain transactions.

Q17: Can a new filer immediately become eligible?

A: Yes, upon filing a return and declaring sufficient resources.

Q18: Are gifts or inherited properties covered?

A: If the value exceeds threshold, source declaration may be required.

Q19: What if I file return after transaction?

A: It must be filed before the transaction date to be considered eligible.

Q20: When does this rule apply?

A: Upon notification by Federal Government, expected after enactment of Finance Act 2025.

Section 114C is a bold move by the FBR to integrate compliance enforcement with economic behavior. It ensures that only documented and tax-compliant individuals can make high-value purchases, invest, or withdraw large sums.

If you’re a non-filer, this section will limit your financial freedom. The solution?

👉 File your returns, declare your assets, and become an eligible taxpayer.

Good web site! I truly love how it is easy on my eyes and the data are well written.

Thanks for posting. I really enjoyed reading it, especially because it addressed my problem.

Thank you for sharing this article with me. It was useful for us.

Your articles are extremely helpful to me. Please provide more information