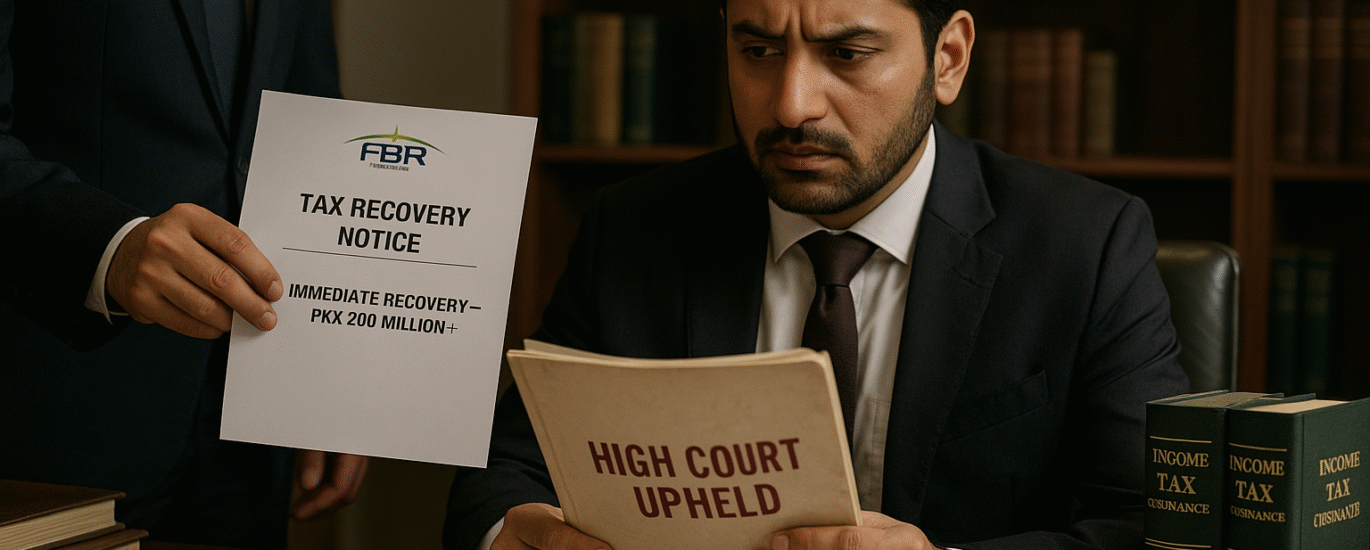

Through the Finance Bill 2025, the Government of Pakistan has introduced a significant amendment in Section 138 of the Income Tax Ordinance, 2001, by inserting a new sub-section (3A). This provision empowers the Federal Board of Revenue (FBR) to recover tax amounts immediately, even if further appeals are pending — but only under strict conditions.

This change aims to prevent tax revenue delays when a case has already been upheld in the department’s favor by multiple judicial and quasi-judicial forums.

⚖️ Legal Text Summary – Section 138(3A)

According to the amendment:

Where a tax demand has been upheld in favor of the FBR at three appellate forums including the High Court, and the demand exceeds PKR 200 million, the Commissioner is empowered to recover the tax immediately, notwithstanding any:

Ongoing appeal,

Court ruling to the contrary,

Stay order, or

Time limitation provided under any other section.

✅ Conditions for Immediate Tax Recovery

Recovery under Section 138(3A) is only allowed when all of the following three conditions are met:

| Condition | Explanation |

|---|---|

| 🏛️ Case decided in FBR’s favor at three forums | Including High Court and any two other appellate authorities |

| 💰 Tax payable exceeds PKR 200 million | This threshold limits application to large-scale cases |

| 💵 Amount recovered shall not exceed the lowest confirmed demand | Ensures fairness where differing amounts are upheld across forums |

🧠 Rationale Behind This Provision

Tax litigation often continues for years, with large tax demands caught in legal limbo, depriving the exchequer of critical revenues. This amendment:

Reduces fiscal delays

Applies to high-value cases only

Ensures at least three levels of judicial validation

Provides certainty for enforcement even if a Supreme Court appeal is pending

📌 Example for Clarity

Suppose:

A taxpayer receives a tax demand of PKR 500 million.

The demand is upheld by the Commissioner Appeals, Appellate Tribunal Inland Revenue (ATIR), and the High Court.

However, the High Court confirms PKR 220 million, while the other two confirm higher amounts.

In this case:

The FBR may immediately recover PKR 220 million (the lowest confirmed amount) under Section 138(3A),

Even if the taxpayer files an appeal in the Supreme Court.

🧾 20 Frequently Asked Questions (FAQs)

Q1: What is Section 138(3A)?

A: It allows FBR to recover tax immediately if the demand is confirmed by three appellate forums, including the High Court.

Q2: Is the taxpayer allowed to appeal further?

A: Yes, but the tax confirmed under 138(3A) can still be recovered immediately during such appeal.

Q3: What is the minimum amount for this section to apply?

A: The confirmed demand must exceed PKR 200 million.

Q4: Which forums are considered for the three levels?

A: Typically, Commissioner Appeals, Appellate Tribunal, and High Court.

Q5: What amount will be recovered if forums confirmed different figures?

A: The lowest amount confirmed by any of the three forums.

Q6: Does this override stay orders from the courts?

A: Yes, the section begins with a non-obstante clause, overriding contrary rulings or laws.

Q7: What if the taxpayer wins in the Supreme Court later?

A: The taxpayer may seek refund or adjustment as per law.

Q8: Is this provision retrospective?

A: No. It applies to cases after the enactment of Finance Act 2025.

Q9: Who initiates the recovery?

A: The Commissioner Inland Revenue is empowered under this section.

Q10: Is a recovery notice required?

A: Yes, but it may not follow the usual timelines since immediate recovery is permitted.

Q11: What legal remedy does a taxpayer have?

A: The taxpayer may approach higher courts, but recovery may still proceed.

Q12: Is this applicable to sales tax or federal excise cases?

A: No, this provision applies under the Income Tax Ordinance, 2001.

Q13: Can ATIR or Commissioner-Appeals decisions alone trigger this?

A: No. High Court decision is essential among the three.

Q14: Does this affect installment plans?

A: It may override installment schedules if conditions are met.

Q15: Will this provision be applied automatically?

A: Application is discretionary but legally authorized.

Q16: Can multiple tax years be clubbed for PKR 200 million?

A: The law refers to tax payable, implying per case, not cumulative years.

Q17: What if the taxpayer has already paid part of the tax?

A: Only the outstanding balance would be subject to recovery.

Q18: Can FBR freeze bank accounts under this section?

A: Yes, Section 138 allows enforcement actions including bank attachment.

Q19: What happens to penalties and default surcharge?

A: Only confirmed principal tax (as per lowest forum) is recoverable under this clause.

Q20: Does this change burden of proof?

A: No. It only affects the timing and enforceability of collection.

Section 138(3A) significantly strengthens FBR’s enforcement powers against tax defaulters in litigation-prolonged high-value cases. It ensures that revenue recovery is not indefinitely stalled once multiple forums — including the High Court — have sided with the tax department.

For taxpayers, it’s a reminder to:

Prepare thorough appeals,

Maintain clean records, and

Plan for potential recovery, even during ongoing litigation.