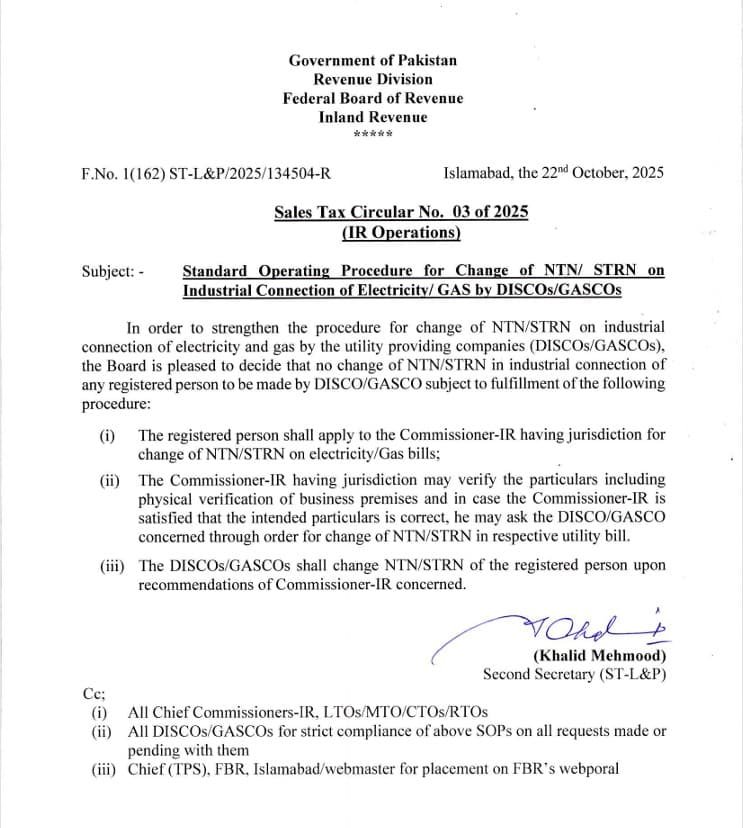

Date of Circular: October 22, 2025

Circular Reference: F. No. 1(162) ST-L&P/2025/134504-R

Issued by: Inland Revenue – Federal Board of Revenue (FBR), Government of Pakistan

The Federal Board of Revenue (FBR) has released Sales Tax Circular No. 03 of 2025 (IR Operations) introducing a Standard Operating Procedure (SOP) for changing the National Tax Number (NTN) or Sales Tax Registration Number (STRN) on industrial connections of electricity and gas.

This initiative aims to ensure transparency, eliminate misuse of industrial utilities, and align utility records with verified business entities under the FBR’s database. The circular provides a detailed mechanism for how DISCOs (Distribution Companies) and GASCOs (Gas Supply Companies) are to process requests involving any change of NTN/STRN.

Core Objective of the Circular

The FBR observed that unauthorized or unverified changes of NTN/STRN were taking place directly by utility providers, resulting in misuse of industrial connections and tax evasion risks.

To curb this practice, the Board has restricted DISCOs and GASCOs from changing NTN/STRN unless a specific verification procedure—as outlined below—is duly followed and approved by the Commissioner Inland Revenue (IR) having jurisdiction.

Key Procedure Defined by FBR

According to the circular, no change of NTN/STRN in industrial connections shall be made by any DISCO or GASCO unless the following conditions are satisfied:

-

Application by Registered Person

The concerned taxpayer (registered person) must apply to the Commissioner-IR who has jurisdiction over the respective area for the change of NTN/STRN on the electricity or gas bills. -

Verification by Commissioner-IR

The Commissioner Inland Revenue may conduct a physical verification of the business premises.

If, upon verification, the Commissioner is satisfied that the intended particulars are correct and genuine, he or she may direct the relevant DISCO or GASCO to update the NTN/STRN in their system through a formal written order. -

Implementation by DISCOs/GASCOs

Upon receiving official recommendations from the Commissioner-IR, the utility company (DISCO or GASCO) shall effect the change of NTN/STRN on the respective utility bill and internal system.

Example Scenario 1:

Case of ABC Textiles (Pvt.) Ltd.

ABC Textiles operates an industrial unit in Karachi and holds an electricity connection from K-Electric under NTN “1234567-8”. The company recently underwent a merger and obtained a new STRN.

Under the new SOP, ABC Textiles cannot directly request K-Electric to change the NTN/STRN. Instead, the company must:

-

Apply to the Commissioner-IR (Corporate Zone, Karachi),

-

Facilitate verification of its business premises, and

-

Await written approval from the Commissioner before K-Electric updates its billing records.

This procedure ensures that the industrial connection remains aligned with genuine registered taxpayers, minimizing fraudulent transfers.

Example Scenario 2:

Case of PakChem Industries – Industrial Gas Connection

PakChem Industries, based in Faisalabad, intends to transfer its industrial gas connection (from SNGPL) to a new subsidiary registered under a separate STRN.

According to the Circular:

-

SNGPL cannot alter the STRN on its own.

-

The company must obtain prior written authorization from the Commissioner-IR Faisalabad, who will verify the authenticity of both entities.

-

Once verified, SNGPL shall proceed with the update under official instructions.

Administrative Compliance

The circular further directs:

-

All Chief Commissioners-IR, LTOs, MTOs, CTOs, and RTOs to ensure compliance within their jurisdictions.

-

All DISCOs and GASCOs to strictly adhere to this SOP before approving any NTN/STRN changes.

-

The Chief (TPS), FBR Islamabad, to place the circular on FBR’s official web portal for public accessibility.

“The Board is pleased to decide that no change of NTN/STRN in industrial connection of any registered person to be made by DISCO/GASCO subject to fulfillment of the following procedure…”

— FBR Circular No. 03 of 2025 (IR Operations), dated 22nd October 2025.

The FBR’s Sales Tax Circular No. 03 of 2025 is a pivotal regulatory step toward safeguarding fiscal transparency and curbing misuse of industrial utility connections.

By making the Commissioner Inland Revenue a mandatory part of the verification process, the government ensures that every industrial NTN/STRN change is validated, documented, and compliant with tax laws.

This initiative not only streamlines interdepartmental coordination between FBR and utility providers but also strengthens Pakistan’s tax enforcement framework by linking industrial consumption directly to registered, verifiable taxpayers.

Disclaimer

This article is intended solely for informational purposes and does not constitute legal or professional advice. Readers are advised to consult a qualified tax practitioner or legal counsel for personalized guidance based on their specific business circumstances. The author assumes no responsibility for any reliance placed on the information contained herein.