A Legal & Tax Commentary

Introduction

Download original S.R.O. 1775(I)/2025

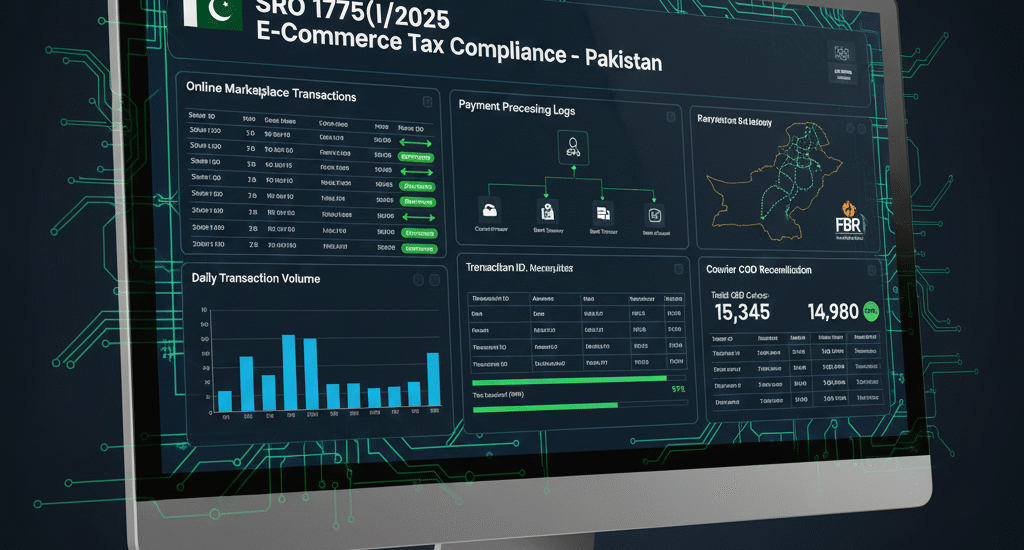

On 10 September 2025, the Federal Board of Revenue (FBR) issued S.R.O. 1775(I)/2025, introducing sweeping amendments to the Income Tax Rules, 2002, primarily targeting online marketplaces, payment intermediaries, and courier services.

This SRO is part of Pakistan’s broader policy objective to bring digital commerce, online selling platforms, cash-on-delivery networks, and payment processors within a structured tax compliance ecosystem.

These amendments have substantial implications for:

-

E-commerce operators

-

Third-party sellers

-

Wallet companies

-

Aggregators

-

Payment processing companies

-

Courier companies (COD & logistics)

-

Marketplaces operating under the “facilitator model”

This blog provides a detailed, human-toned, legal commentary on each clause of the SRO.

1. Purpose and Legislative Intent of S.R.O. 1775(I)/2025

The SRO seeks to:

-

Digitize tax reporting,

-

Regulate online transactions,

-

Document payments made through marketplaces,

-

Expand the statutory domain of Section 165C (Statements of online marketplaces, payment intermediaries, and couriers),

-

Establish new mandatory statements and forms,

-

Ensure traceability of sellers using online platforms,

-

Introduce Rule 38A, specifically governing the monthly compliance framework.

2. Insertion of Rule 38A — The Cornerstone of the New Framework

The most significant amendment is the insertion of Rule 38A, prescribing the compliance framework for online marketplaces under Section 165C(1).

Key Requirements Under Rule 38A

Each online marketplace must submit:

-

Monthly Statement A-1

-

Comprehensive seller profiling

-

Sale volume information

-

Commission, fee, and charges levied

-

Payment details, whether disbursed or in escrow

-

-

Monthly Statement A-2

-

Transaction-wise disaggregation

-

Gross sales, refunds, returns

-

Mode of payment (COD, digital, bank transfer)

-

Tax collected/deducted wherever relevant

-

Implications

This brings online marketplaces on par with major withholding agents and compels them to maintain exacting tax-grade records.

3. Amendments in Rule 44 — Quarterly Statements for Payment Intermediaries & Couriers

SRO 1775(I)/2025 substantially replaces parts of Rule 44, mandating quarterly submissions by:

(a) Payment Intermediaries (PI)

Those who process payments for third parties, including:

-

Wallet services

-

Mobile operators (financial services)

-

Payment gateways

-

Aggregator platforms

New obligation:

Submission of a detailed Form 11, covering:

-

Amounts processed

-

Beneficiary details

-

Settlement amounts

-

Merchant accounts

-

Discrepancies and chargebacks

(b) Courier Services

Courier companies that handle COD payments must file Form II, detailing:

-

Parcels delivered

-

Amount collected on behalf of sellers

-

Delivery charges

-

Deposited amounts

-

Undelivered parcels & returned COD

-

Seller identity & NTN

Purpose

COD is the largest leakage point in Pakistan’s undocumented economy. This rule formally plugs that gap.

4. Introduction of New Forms (Completely Replaced)

The SRO introduces multiple new statutory forms:

Form A-1 (Monthly – Online Marketplaces)

Contains:

-

Seller profile, NTN, CNIC

-

Store name, digital address

-

Nature of goods sold

-

Commission, fulfilment fees

-

Total orders processed

-

Gross and net sales

Form A-2 (Monthly – Detailed Transactions)

Row-level sale details:

-

Order number

-

Item code

-

Quantity, price

-

Shipping charges

-

Discounts, returns, cancellations

-

Actual payment received

-

Mode of settlement

Form 11 (Quarterly – Payment Intermediaries)

Includes:

-

Total payments processed

-

Merchant settlements

-

Withholding where applicable

-

Digital wallet activity

-

Electronic transfer details

Form II (Quarterly – Courier Companies)

Includes:

-

Number of deliveries

-

COD amount collected

-

Commission/delivery fee charged

-

Payable amount to sellers

-

Undelivered parcels

-

Return-to-origin (RTO) reports

5. Statutory Backing Under Section 165C

All these amendments fall under Section 165C, which authorizes the Board to require:

-

Marketplaces

-

Payment intermediaries

-

Couriers

…to furnish statements of transactions conducted on behalf of sellers, merchants, or users.

Impact

By expanding Rule 38A and Rule 44, the SRO operationalizes Section 165C in a fully enforceable manner.

6. Compliance Frequency & Deadlines

| Entity Type | Required Statement | Frequency |

|---|---|---|

| Online Marketplace | Form A-1 | Monthly |

| Online Marketplace | Form A-2 | Monthly |

| Payment Intermediary | Form 11 | Quarterly |

| Courier Company | Form II | Quarterly |

Deadlines coincide with the standard submission cycle under Chapter VII of Income Tax Rules, unless separately notified.

7. Penalties for Non-Compliance

Non-submission or late submission triggers:

-

Section 182(1) penalties

-

Minimum PKR 2,500 per day

-

Maximum PKR 200,000 for failure

-

Possible audit under Section 177

-

Suspension of facility or registration in severe cases

As Rule 38A falls under a compliance-enforcing SRO, non-submission could also be interpreted as deliberate tax suppression.

8. Compliance Challenges for Businesses

Online Marketplaces

-

Must overhaul data-collection capacity

-

Must compile seller verification logs

-

Must digitally record every transaction

Payment Intermediaries

-

Need system-level extraction

-

Must map merchant codes

-

Must maintain real-time reconciliation

Courier Services

-

Must digitize entire COD mechanism

-

Must track undelivered/returned items

-

Must maintain daily reconciliation of COD funds

9. Benefits of SRO 1775(I)/2025

✔ Brings e-commerce within documented economy

✔ Reduces revenue leakages

✔ Ensures tax-grade reporting

✔ Protects sellers and consumers

✔ Encourages digital payments

✔ Enhances transparency in COD operations

✔ Restricts unregistered businesses from online selling

S.R.O. 1775(I)/2025 marks a transformative shift in Pakistan’s tax documentation regime. By formalizing the obligations of online marketplaces, payment intermediaries, and courier companies, the FBR has established an integrated, technology-compatible compliance framework.

These rules will not only strengthen revenue monitoring but also standardize e-commerce practices, making Pakistan’s digital economy more transparent and tax-compliant.

For businesses subject to these rules, professional tax compliance support is now essential to avoid penalties and ensure statutory accuracy.

FAQs on S.R.O. 1775(I)/2025 — Online Marketplaces, Payment Intermediaries & Courier Services

1. What is S.R.O. 1775(I)/2025?

It is a statutory regulatory order issued on 10 September 2025, amending various provisions of the Income Tax Rules, 2002, specifically introducing mandatory compliance obligations for online marketplaces, payment intermediaries, and courier services under Section 165C of the Income Tax Ordinance, 2001.

2. Which entities are covered under this SRO?

The SRO applies to:

-

Online marketplaces

-

Payment intermediaries (wallets, gateways, processors)

-

Courier and logistics companies handling COD payments

3. What is the purpose of SRO 1775(I)/2025?

Its purpose is to strengthen tax documentation, regulate e-commerce transactions, monitor COD payments, and ensure accurate reporting of digital and marketplace transactions.

4. What is Rule 38A introduced through this SRO?

Rule 38A mandates monthly statements (Form A-1 and A-2) to be filed by all online marketplaces, detailing seller profiles, sales data, commissions, and transaction-level information.

5. What is Form A-1 and what information does it require?

Form A-1 is a monthly seller-level statement, requiring:

-

Seller identity (NTN/CNIC)

-

Sales volume

-

Commission/fees

-

Payment details

-

Goods or services sold

6. What is Form A-2?

Form A-2 is a monthly transaction-wise statement, containing:

-

Order numbers

-

Gross sales

-

Discounts/returns

-

Payment mode

-

Net settlement amounts

7. Are courier companies required to submit statements?

Yes. Courier companies must submit Form II, a quarterly COD compliance statement detailing deliveries, amounts collected, returns, delivery fees, and payable amounts.

8. What is Form 11?

Form 11 is a quarterly statement to be filed by payment intermediaries showing:

-

Total payments processed

-

Beneficiary/merchant details

-

Disbursement information

-

Chargebacks

-

Settlement amounts

9. What legal provision empowers this SRO?

All obligations stem from Section 165C of the Income Tax Ordinance, which authorizes FBR to require statements from marketplaces, payment intermediaries, and courier services.

10. What are the penalties for non-filing?

Non-compliance attracts penalties under Section 182, including:

-

PKR 2,500 per day of default

-

Up to PKR 200,000 for continued failure

-

Possible audits under Section 177

11. Does this SRO affect small online sellers?

Indirectly, yes. Marketplaces must report detailed information about every seller, so small sellers cannot remain undocumented.

12. Are COD (cash-on-delivery) transactions covered?

Yes. COD is a core focus of this SRO. Courier companies must file quarterly COD reports under Form II.

13. Do online marketplaces now operate as withholding agents?

This SRO does not convert marketplaces into full withholding agents, but it requires detailed reporting that may later support withholding obligations.

14. What types of marketplaces must comply?

All platforms facilitating third-party selling, including:

-

E-commerce websites

-

App-based marketplaces

-

Service marketplaces

-

Aggregators

-

Social commerce platforms with transaction processing

15. What if a marketplace does not collect payments?

Even if the marketplace does not handle payments, it must still file the monthly statements, as long as it facilitates sales.

16. Are digital wallets and payment apps considered payment intermediaries?

Yes. Any entity processing payments for third parties or settling payments between buyers and sellers qualifies as a payment intermediary.

17. Does this SRO also cover international marketplaces?

If they operate within Pakistan or process payments/shipments within Pakistan, they must comply.

18. Are returns, cancellations, and refunds required to be reported?

Yes. Form A-2 requires marketplaces to report all returns, refunds, cancellations, adjustments, and net settlement figures.

19. Does this SRO change tax rates?

No. This SRO concerns compliance and reporting, not tax rates or withholding percentages.

20. What is the overall impact of SRO 1775(I)/2025 on Pakistan’s digital economy?

It significantly enhances transparency, broadens the tax base, reduces cash leakages in COD, enforces seller documentation, and aligns Pakistan’s digital commerce with international standards of tax compliance.