Section 134A Amended – Extended ADR Mechanism for State-Owned Enterprises (Finance Act 2025)

The Finance Act 2025 introduces significant changes to the Alternative Dispute Resolution (ADR) framework under

The Finance Act 2025 introduces significant changes to the Alternative Dispute Resolution (ADR) framework under

The Finance Act 2025 amends Section 131(1) of the Income Tax Ordinance, 2001, to streamline

The Finance Act 2025 introduces a significant compliance requirement for Pakistan’s rapidly growing digital commerce

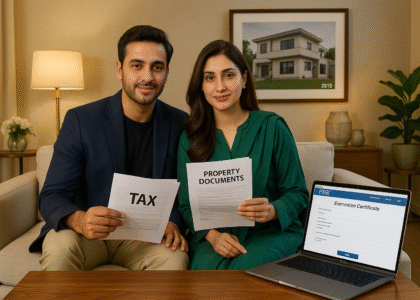

The Finance Act, 2025 brings much-awaited relief to long-term homeowners in Pakistan by inserting sub-section