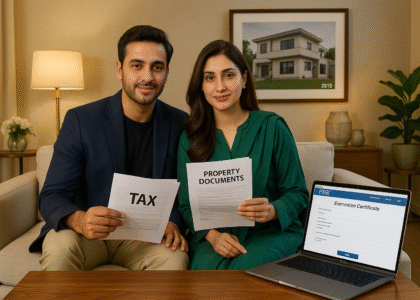

Tax Return Guide for Property Dealers & Real Estate Investors in Pakistan

Real estate continues to be one of Pakistan’s most active investment sectors, but it is

Real estate continues to be one of Pakistan’s most active investment sectors, but it is

Navigating Pakistan’s tax system requires understanding not just the rates but also their legal foundations.

The Finance Act 2025 introduces a critical limitation under Section 214A of the Income Tax

The Finance Act, 2025 brings much-awaited relief to long-term homeowners in Pakistan by inserting sub-section